Merchants’ mixed performance in Q4 2018

Company News, Industry Insights, Lakes People | 26/02/2019Total Builders Merchants fourth quarter sales were a respectable 3.1% higher than in Q4 2017 but look closer and things were less encouraging. The quarter started well, with October sales up 6.8% year-on-year. However November only grew by 0.8% and, as this latest report shows, December was only 1.0% higher than December 2017. Factor in inflation and volumes will have been lower.

The economy is losing momentum, with 2018 growing at its slowest annual rate for six years (ONS). Contributory factors were lower factory output, car production and weaker construction. NHBC new home registrations in 2018 were broadly flat, whilst numbers moving house have fallen. Fewer movers impacts on RMI, with a consequent fall in replacement kitchens, bathrooms, windows, re-decoration and refurbishment work.

The elephant in the room is, of course, Brexit. Nearly two years after Article 50 was triggered and a little over a month to go before the UK’s departure date we remain in a state of limbo. It’s hardly surprising that investment by businesses and home-owners has slowed.

Our Sales & Marketing Director and BMBI Expert, Mike Tattam, comments:

The BMBI figures tell us that the Kitchens & Bathrooms sector underperformed the total merchant market in the last six months of 2018 but performed better than the total market in the previous 18 months.

They also show broad signs of seasonality over the last three years, with Kitchen & Bathroom sales tracking the total merchant market in the winter and spring, underperforming the market in the summer months, then overtaking the total market in the autumn and peaking in November.

But extreme weather can disrupt these patterns. Last years’ winter season was unusually cold, keeping builders and installers indoors which contributed to the Kitchens & Bathrooms category outperforming total builders’ merchants’ sales from November 2017 to March 2018. The hotter than average summer may have encouraged more homeowners and installers to find reasons to be outside. A small fall in housing transactions in Q2 and Q3 2018 will also have reduced the number of projects.

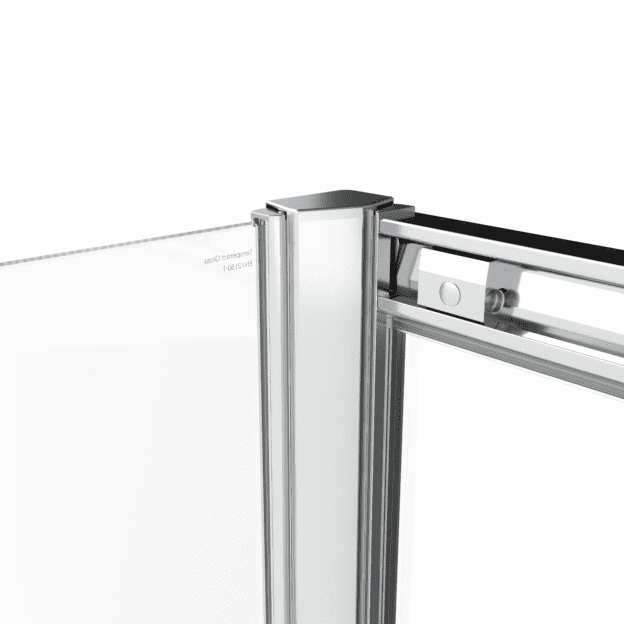

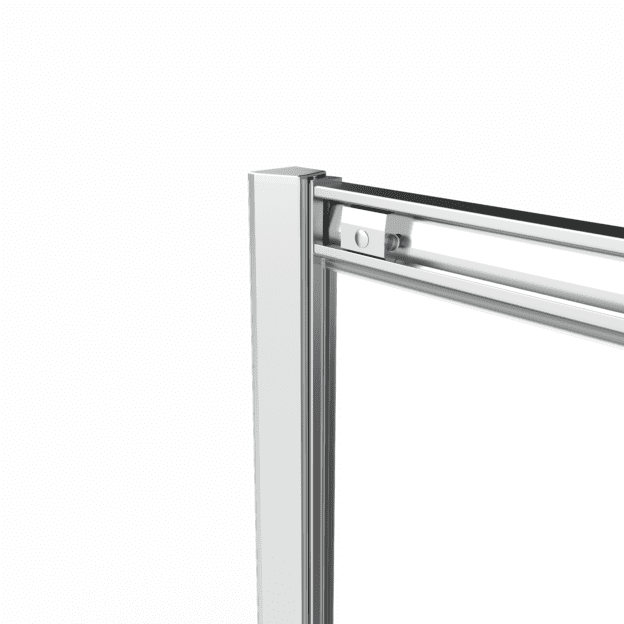

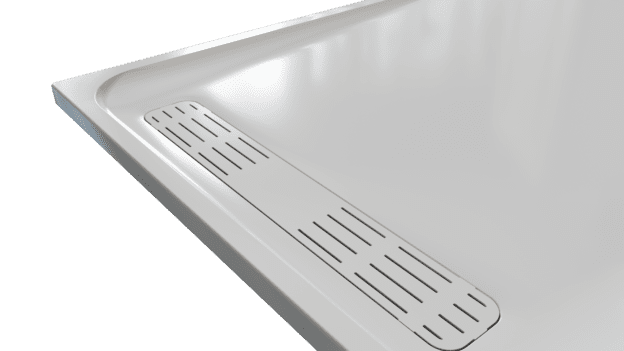

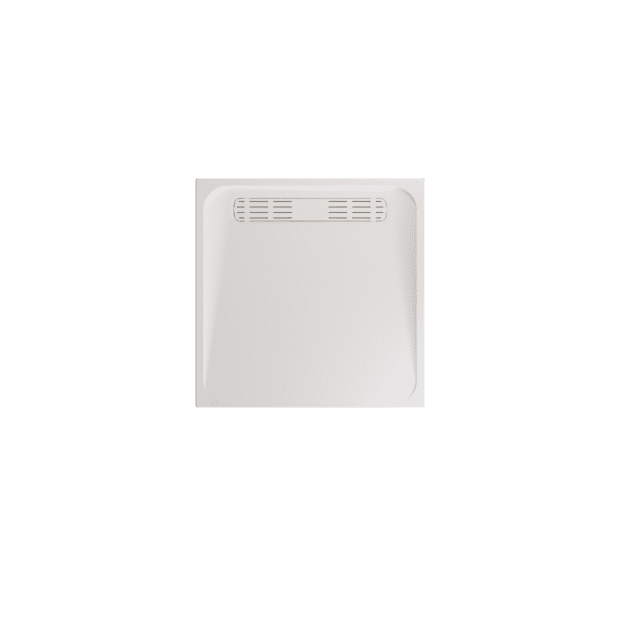

Long-term trends in the bathroom sector also influence these sales statistics to varying degrees. The pressure on living space in new homes, as housebuilders maximise the number and value of the houses they build on the land available, favours showering spaces instead of baths. Housebuilders also add value with ensuite ‘bathrooms’ and wet rooms.

The political turmoil and economic uncertainty created by an imminent Brexit is weakening consumer confidence and is probably having the greatest effect on larger improvement projects. There is abundant anecdotal evidence of projects being postponed or just not progressed.

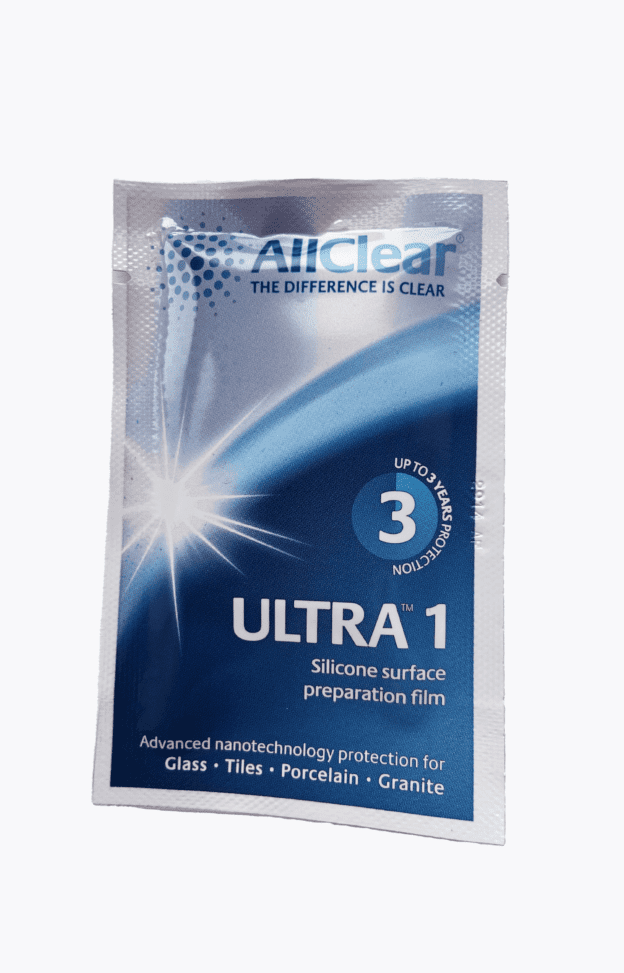

Without a clear voice from Government, it’s near impossible to be certain what Brexit we should plan for. However, Lakes has prepared as best we can to supply our stockist partners with the minimum of disruption, whatever form Brexit takes.

In the aftermath to Brexit, the ‘Have’s, particularly the over 55-year old homeowners who have become the biggest drivers of higher-end home improvement sales, will be relatively unaffected. Even in the most disruptive scenarios, where house prices lose a large part of their value, they remain house-wealthy with their savings and pensions, still keen to improve their lives and properties.

To download the latest report, view Expert comments or watch the Round Table videos, visit www.bmbi.co.uk