Kitchen and Bathroom trends

Company News, Industry Insights | 20/02/2019In the latest article for BMF One Voice, our Sales & Marketing Director Mike Tattam and the BMBI Expert for Shower Enclosures & Showering comments on trends in BMBI’s Kitchen and Bathroom statistics:

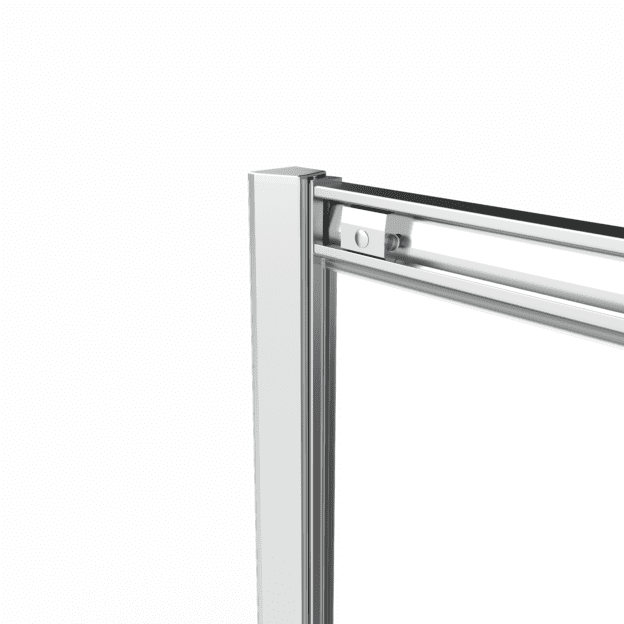

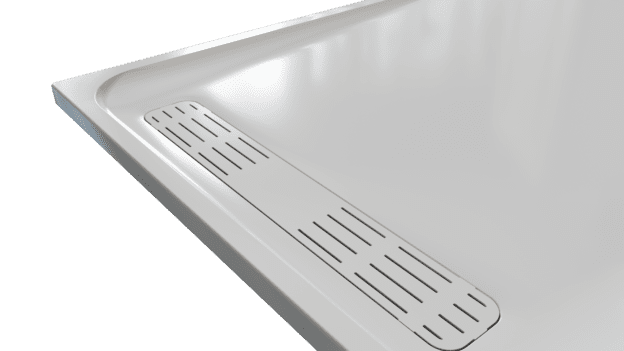

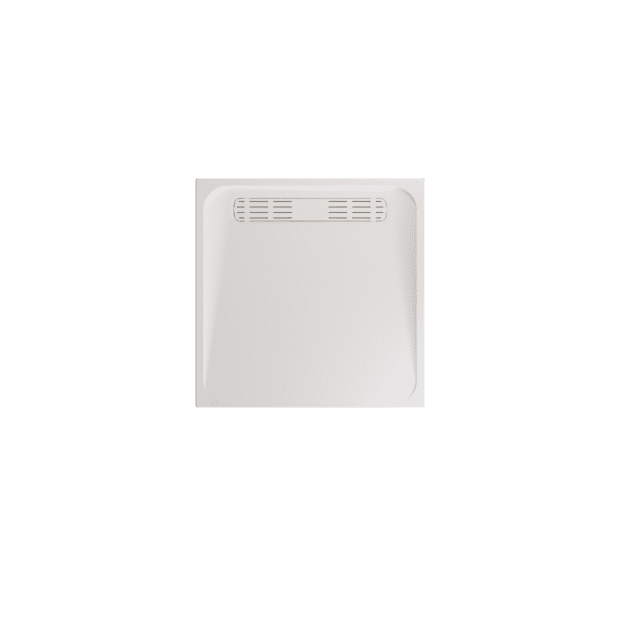

BMBI is a brand of the BMF. It’s produced by MRA Marketing using gold standard data from GfK, one of the largest insight agencies. GfK’s Builders Merchant Point of Sale Tracking Data analyses sales out data from over 80% of generalist builders’ merchants’ sales across Great Britain. BMBI is a growing platform to influence and argue for what matters to the industry, and a unique platform for building brands. A monthly index and quarterly reports include tables and trends plus insights from GfK and the BMF, and 14 BMBI Experts, leading brands that speak exclusively for their markets. They are: Alumasc Water Management Solutions (AWMS), Crystal Direct, Dulux Trade, Encon Insulation, Hanson Cement, Heatrae Sadia, Ibstock Bricks, IKO PLC, Keylite Roof Windows, Keystone Steel Lintels, Knauf Insulation, Lakes Showering Spaces, Natural Paving Products and Timbmet.

“The figures in the latest BMBI report (November) indicate that there have been some changes in the Kitchens & Bathrooms category over the last few years, with the November 2018 figures appearing to show a negative trend. But while it’s true that the sector underperformed the total merchant market in the last six months of 2018, Kitchens & Bathrooms performed better than the total market in the previous 18 months.

“Looking at the data for the last three years, there are clear signs of seasonality, with Kitchen & Bathroom sales tracking the total merchant market in the winter and spring, underperforming the market in the summer months and then overtaking the total market and peaking in November.

“One feature of last years’ winter season was the unusually cold weather, which kept builders and installers indoors and contributed to the Kitchens & Bathrooms category outperforming builders’ merchants’ sales as a whole from November 2017 to March 2018. It is likely that the hotter than average summer that followed and the net 2.8% fall in housing transactions during Q2 and Q3 2018 had an impact of Kitchen & Bathroom sales over the summer and into the autumn.”

Richard Frankcom Key Account Director for GfK adds: “At the back end of 2017 the Kitchens and Bathrooms category was showing faster revenue growth than volume growth, so there was price inflation.

“During 2018, revenue growth has slowed and prices have increased at a slower rate than total builders’ merchants in Kitchen and Bathroom categories with no compensating impact on volumes, resulting in slower value growth and hitting the largest sub category bathrooms more than kitchens. Other factors may be influencing these trends to varying degrees too such as a continuing long term slide in sales of baths, growth in wet rooms, and the current political and economic uncertainty which is contributing to weaker consumer confidence, with anecdotal evidence of projects being postponed.”

To download the latest reports, Expert comments or the 3rd Round Table Debate videos, visit www.bmbi.co.uk. Follow @TheBMBI.