BMBI reports Strong Q1 for Kitchens & Bathrooms

Company News, Facts & Figures, Industry Insights, Lakes People | 23/05/2019Total Builders’ Merchants value sales to builders, contractors, and kitchen and bathroom installers were up 5.9% in the first quarter of 2019, compared with Q1 2018. Product categories that grew strongly included Timber & Joinery, up 6.6%, Heavy Building Materials, up 6.8%, and Landscaping, which saw value growth of 15.6% as the year got off to a better start than 2018 with the milder weather. Bathrooms & Kitchens sales were up 1.1% year-on-year.

Compared with Q4 2018, Total Builders Merchants’ sales in Q1 2019 increased by 1.9%, but average sales a day (which takes into account the difference in trading days) were 3.0% lower over the same period. Sales in the Kitchens & Bathrooms category were up 4.7% on the previous quarter, achieving a higher growth rate than many other categories.

Total sales in March 2019 were up 8.3%, with the milder weather impacting positively compared to the same period last year. Kitchens & Bathrooms sales were up by 2.1%. Product categories that displayed the highest growth year-on-year were those related to external work. Timber & Joinery was up by 9.2% and Heavy Building Materials by 9.4%, while landscaping saw an even greater increase at 25.6% in March.

Mike Tattam, Lakes Sales & Marketing Director and BMBI Expert for Shower Enclosures & Showering, comments:

“Much as we’d like to, it’s hard to block out the effects of Brexit on our lives and businesses. Businesses are frustrated by having to divert their time and focus from helping customers compete more effectively and grow, to focusing on minimising the potential disruption and delays from one of these outcomes so they can compete at all.

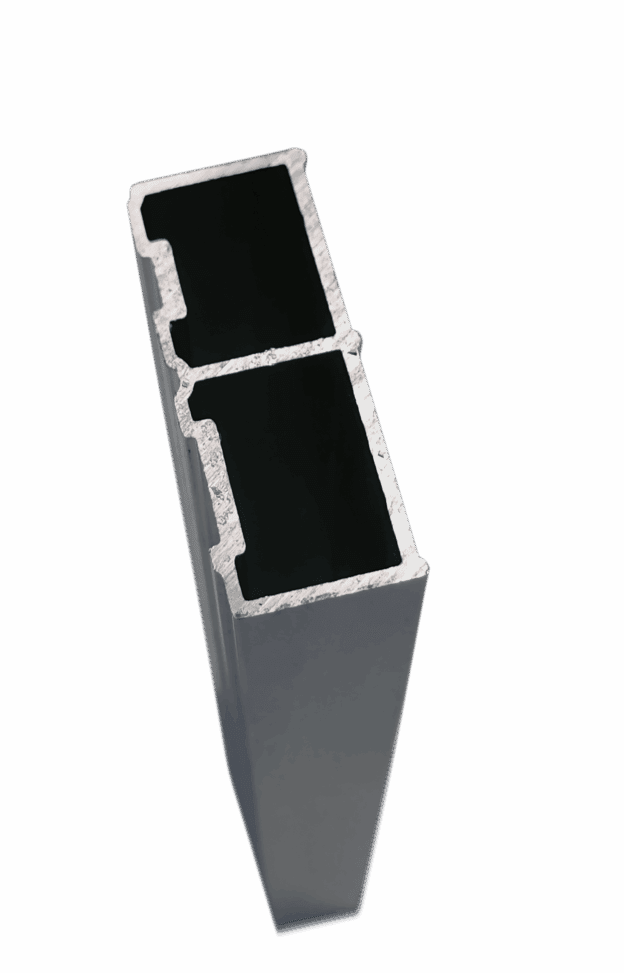

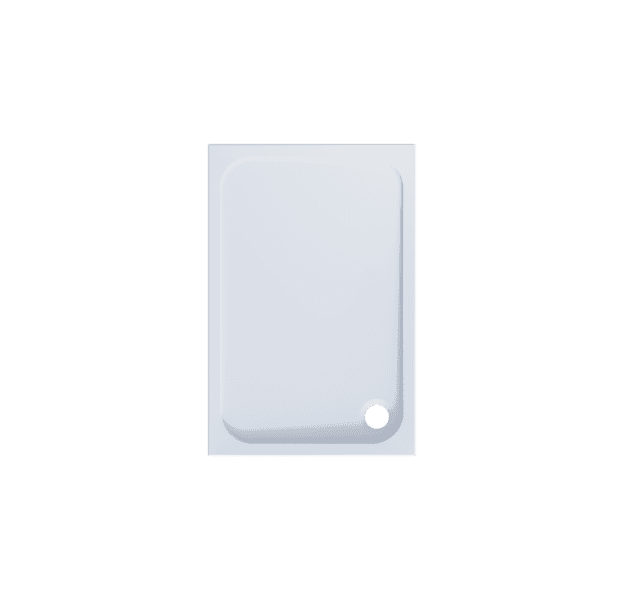

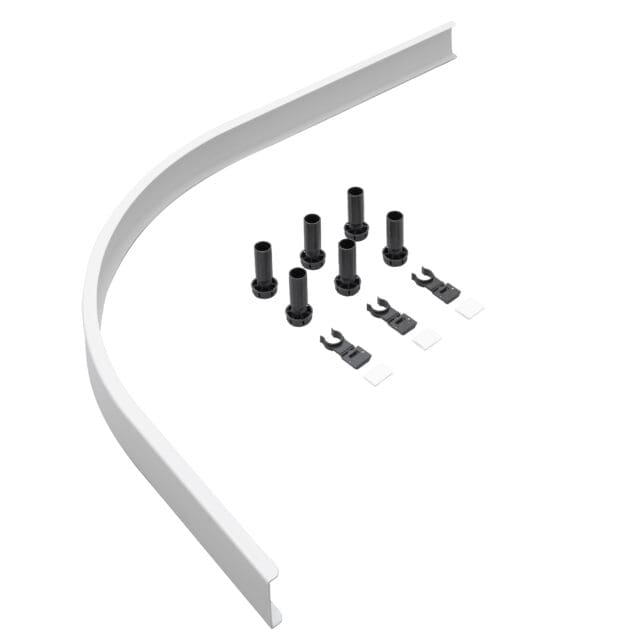

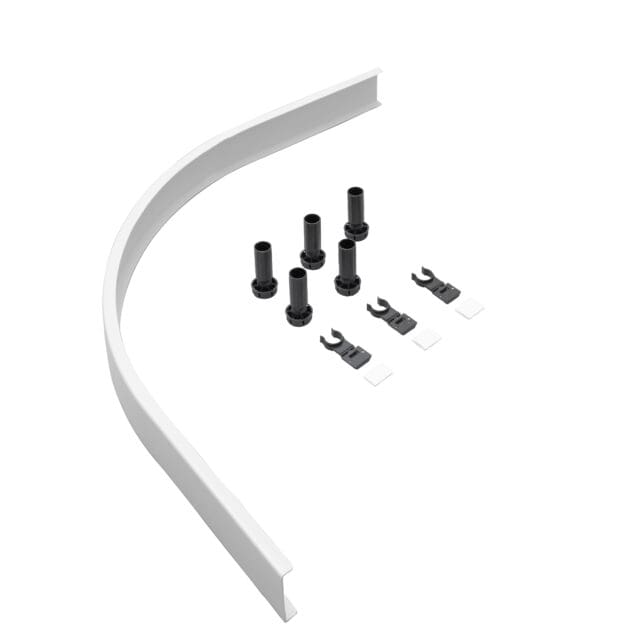

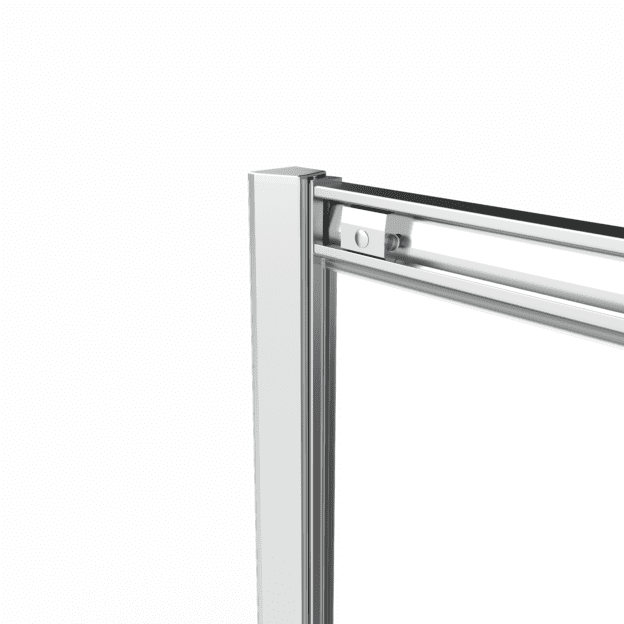

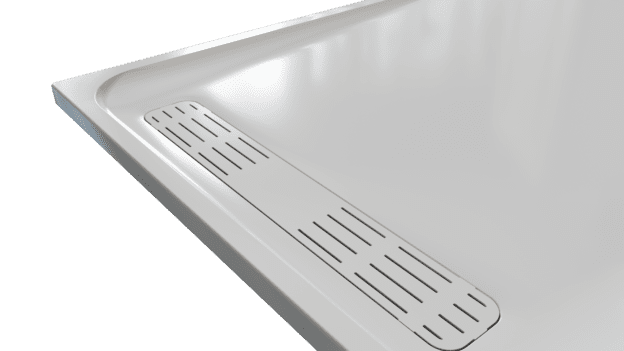

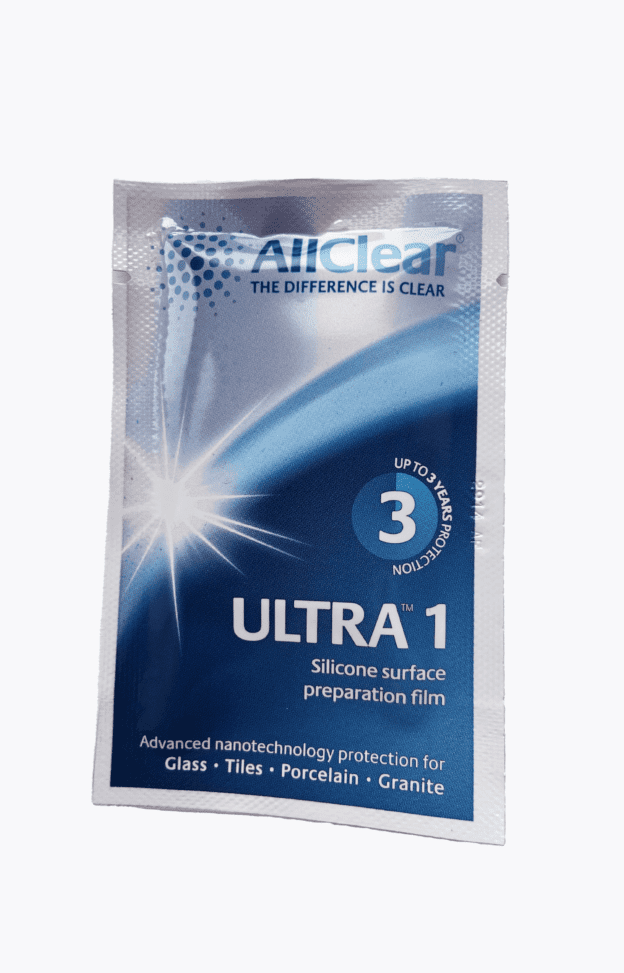

“Whether shower enclosure companies have their products made for them, or they manufacture as Lakes does in its own factory, most companies import, mostly from China. So, all brands have to factor in shipping, long lead times, port access, currency movements – and road haulage for the final leg of the journey – so customers can sell without disruption.

“There have been fewer delays caused by ships being diverted from UK ports, but it can take 48 hours getting through French ports as customs officials start flexing their muscles. The Road Haulage Association says there are not enough HGV drivers in the UK, and many EU nationals are returning home because their markets are good, wages are improving and there’s plenty of work.

“Many companies built up their stocks in Q1 to unprecedented levels to ensure continuity of supply in time for an unruly EU exit on 29th March. But carrying and funding up to five and half months’ stock in the short term is quite different from carrying it through to October 31st, the postponed exit date or beyond.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.